The new cover of TIME Magazine — and you can argue over how relevant TIME Magazine is to the modern day, but it’s still a thing millions of people at least glance at on newsstands every week — is a picture of a baby speculating that this baby, in said picture, could live to be 142 years old. Indeed. This is a whole thing. By some measures 1 in 3 people born today — right now, today, as in the next 12-24 hours — will live to be 100. Our resources are pretty strained as it is — most people estimate the Earth could reasonably support about 4 billion humans, and we’re going to be more than double that within about 20-30 years — so if you have strained resources + people living longer + climate change, that’s a doomsday scenario, right? Yes and no. Those types of scenarios are what futuristic dystopian action movies are set around, but we should also remember that the human race is fairly capable of adapting to new situations — we’ve been doing it for centuries — and ideally, someone will come along and do for population growth and food sources what Steve Jobs did for a flashy phone in your pocket. That’s the dream, at least.

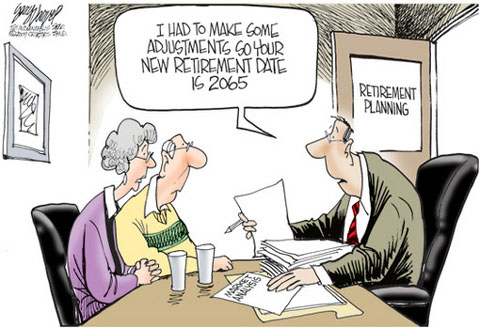

Still, we approach aging and retirement almost totally wrong right now — at least in how we think about some of the statistics and ideas involved. Here are a few examples.

Start here. That’s from Stanford University and more specifically professor Laura Carstensen, who is the founding director of the Stanford Center on Longevity. There’s a long (1 hour+) video with her here:

(FYI: Google, which is a company that often skates to where the puck is instead of where the puck was, is also all over this longevity space.)

Alright, so … if you look through the Stanford post, you’ll find a couple of insane ideas. Here are just a smattering.

1. We used to live about nine years into retirement; by 2050 it will be 22 years into it.

That’s a shift, eh? That’s almost triple over about, what, 60-70 years? That leads directly to …

2. Unless you are extremely wealthy, it’s nearly impossible to finance a 30-year retirement from a 40-year career.

John Shoven talks about this a lot:

The dual problems here: earnings seem to be stagnating, while the relevance of your last name/family title seems to be about as important as it was in the 1400s. That’s not good.

3. 14 percent of Baby Boomers have no retirement income at all; 43 percent of those over 55 have less than $25,000.

That means close to 1 in 2 people over 55 have less than 1/4 of $100K saved. Even with a super spartan lifestyle, that will go maybe 2-3 years at most. If your retirement is now slated to last 22 years (Point 1), you need a lot more money. Or … you need to burn money and leave the broader notion of “experiences” to your offspring/children. (That said, you need a source for that money.) When we talk about concepts like “income inequality eroding our trust in each other,” which is a very real thing, this is part of what we’re discussing. There’s enormous frustration that comes with not being able to live according to the script you were promised; frustration gradually chips away at trust and bonds.

4. Financial literacy is still a terrible program at most places

Here’s a quote from the Stanford article:

We must rethink how to educate consumers about their savings. Companies, research institutes and government agencies are already shifting how they prepare their people for retirement. Some are making contribution plans look more like pension plans that are default, not opt-in. Companies are also learning that if they want to help their employees with retirement, they have to help those employees with all the other major spending decisions, from buying a house to putting the kids through school.

I’ve never understood this part of it. Like, never. If you have a workforce and you’re worried about engagement and keeping your best people and providing purpose and the like, the literally easiest way is this: you have a company, so you probably have a financial arm, no? Maybe a CFO? An accounting presence? Take those people — who know these things, ostensibly — and have them lead free seminars in-house on finance. Now, personal and corporate finance are different, yes. There’s no doubt there. But if you want to “show employees you care,” which you should just because you’re a good person but oftentimes that’s not enough, there’s an easy way to do it. Offer them in-house seminars and trainings free of charge that can benefit their life. That way, they don’t have to search or make appointments with a counselor or whatever else. They can get some knowledge from those that already have it in the same building. That’s good, right?

It’s amazing how awful financial literacy is across the board. (Mine is terrible too.) I went out for drinks with my friend in NYC once, a few years ago. Dude had 7 credit cards. I asked him why. He said, “Well, I use one, then I use the next one to pay that one off, and so on and so forth.” I know nothing, but I had this one covered. “Um, that’s just transferring debt.” He looked at me quizzically. “No it’s not. It’s just using one card to pay the other card.” (Pause.) “Right, that’s just the transfer of debt.”

Saddest part about that story? For a while, that kid worked for UBS in a financial role.

Point is: we need to rethink and re-contextualize retirement ideas. What other choice do we have? In the early 1900s, people generally lived to 49. Now it’s 79. That’s a 30-year uptick across 3-4 generations max. What if we stay at that pace? How do we think about salaries and investment and doctors and everything else then?