2008 was a rough housing crisis, for sure. The general belief these days is that we’re out of it and things are better — Home Depot seems to explain/believe that as well — but in fact, we may not be, and instead, 2015 may be Housing Crisis V2. Gird your loins.

Here’s an article from Richard Florida (at this point I’d call him a journalistic man crush) over at CityLab / Martin Prosperity Institute, and here are a few takeaways:

- If you look at Trulia’s “Housing Barometer”, existing home sales are currently 80 percent of the way back to “normal” (i.e. pre-2008 levels), but home prices are only 75 percent of the way back, meaning they’re under-valued by about 4 percent.

- Bigger problem? New construction is only 49 percent of the way back to normal. (Suck it, Home Depot!)

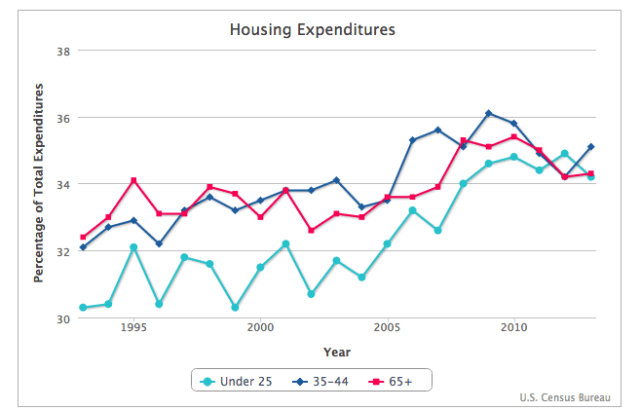

- Housing expenditures as a percentage of household income are rising. Look at this graph, for example:

- Just 20 years ago, under 25 year-olds spent about 30 percent of their total expenditure on housing. Now it’s closer to 35. That’s a flip of not even a full generation. Every generation is spending about 4 of every 10 dollars that’s going out on housing.

- (That obviously has big implications for the middle class.)

- Now look at this on homeownership rate:

- That’s the lowest rate in basically two decades.

You can look at all this in a couple of different ways:

1. The middle class really is dead, and it’s pretty much impossible to own the type of house you want to own in the area you want to live in, because someone with more money is going to come in and grab it. Phrased another way, the manager-class is living closer to where they want to, and the worker-class is living farther away.

2. Maybe we shouldn’t even worry about housing and transportation anymore; maybe people should be spending their money on education, human capital, and innovation approaches — that’s what will fuel the new economy. Nobel Prize winners have claimed this too.

3. Here’s Richard Florida’s take, which I mostly agree with:

What we are going through is much more than a generational shift or simple lifestyle change. It’s a deep economic shift—I’ve called it the Great Reset. It entails a shift away from the economic system, population patterns and geographic layout of the old suburban growth model, which was deeply connected to old industrial economy, toward a new kind of denser, more urban growth more in line with today’s knowledge economy. We remain in the early stages of this reset. If history is any guide, the complete shift will take a generation or so.

4. The overall way to look at this is maybe … post-WW2, the policies that the U.S. put in place set forth the suburban growth model. That model is probably getting outdated now, because millennials probably won’t want to settle as much in the burbs. (Huge implications for the real estate market.) Because that model is older, maybe the true calling of the next generation of U.S. political leadership is to put forth policies that could lead to an urban growth model.

Problem is, in the meantime we may hit another housing crisis — because, as Florida notes, it’ll take a generation or more for some of these things to start to take shape.