More than a third of American colleges and universities have deteriorating finances, according to a 2012 report. While more Americans find that a college degree is their only ticket to the middle class, fewer institutions are able to provide it at a reasonable cost.

That’s from an article over at Slate about Southern New Hampshire University, which has purportedly become the “Amazon of higher education” by re-inventing itself as an online course hub. The Slate article is good, and you should read it; it brings up a lot of other points about the current state of higher education, including this:

His solution was to tackle what colleges were doing poorly: graduating students. Half the students who enroll in post-secondary education never get a degree but still accumulate debt. The low completion rate can be blamed partly on the fact that college is still designed for 18-year-olds who are signing up for an immersive, four-year experience replete with football games and beer-drinking. But those traditional students make up only 20 percent of the post-secondary population. The vast majority are working adults, many with families, whose lives rarely align with an academic timetable.

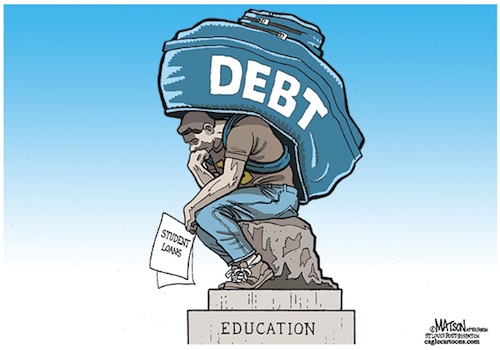

All the other requisite topics are in there — how valuable is an online-focused education to conventional jobs? How quality is the education if it’s mostly cookie-cutter delivery by on-the-cheap professors? Of course all that stuff needs to be mentioned or else the readers will flame the comment section (and of course it’s all valid), but that top paragraph is one of the essential crises of the next 20 years and beyond. How can we have a middle class if the future middle class is entering the workforce $50K in debt from the jump — at a time when wages are suppressed anyway? This could lead to greater focus on passed-down wealth, or could lead to kids hiding in different graduate programs to avoid actually getting out there and looking for something bigger.

Basic equation: students have debt + companies want to maintain thin profit margins + questionable economy = maybe it’s time to reconsider the higher education model as we know it.

This has been written about a ton, but it might be time for action. I think it might take the passing of a few generations because right now, part of the value of college in certain social worlds is the ability for your parents/grandparents to tell their friends where you’re going to school. That’s an important mid-to-late-life ranking schematic for some. Depending on the courses you take and your focus, I honestly don’t see a ton of difference between a place like a UPenn and a place like a University of Missouri (picked those two randomly); I think the focus needs to be on team-centric projects and finding a way to reduce the scale of debt for the students. There are ways to do this. Hell, the U.S. government itself could help do it:

The federal government made enough money on student loans over the last year that, if it wanted, it could provide maximum-level Pell Grants of $5,645 to 7.3 million college students.

This is the issue — the issue — that needs to be fixed in order for the stability of future generations. You can gripe about Southern New Hampshire’s approach, and there are certainly flaws, but at least it’s a start.

6 Comments

Comments are closed.