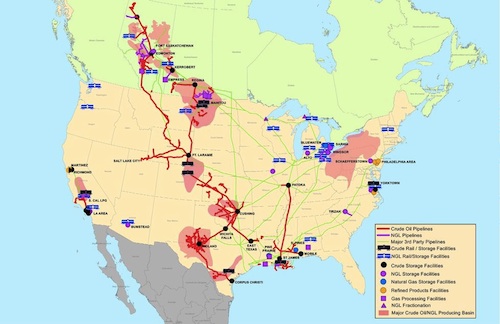

There are roughly 178 million Google hits for “Twitter IPO.” There’s 1.6 million Google News hits right now, and it went public on November 6 — so essentially a month ago. Now, contrast that with Google hits for “Plains GP Holdings IPO.” There’s less than 84,000. Odd in many ways, because it was the biggest IPO of 2013. Plains GP Holdings is an oil and gas company (OK, now you’re starting to get it) that operates pipelines. It’s a spin-off of Plains All-American Pipeline, which has an asset map that looks like this:

(Yea, it’s a pretty big deal in Patoka, IL.)

The Plains GP Holding IPO was actually the biggest for a U.S.-based company since Facebook; the offering was valued at $2.82 billion. 2013 was actually a big year for IPOs overall — it surpassed 2012 in early November — yet Twitter, which easily had the most buzz of any IPO, was actually only the fourth-largest. No. 1 was Plains GP Holding, as described above; No. 2 will be the forthcoming Hilton IPO (Hilton doesn’t actually own hotels anymore; it just uses brand licensing and it operates properties owned by others to make money); and No. 3 was Zoetis, which was spun off by Pfizer and made a little over $2.2 billion. Zoetis is dominant in products that keep pets and livestock living well (well, comparatively), and that market is, in turn, worth about $22 billion. Twitter came in at No. 4. That’s obviously nothing to shake a stick at — try raising $200, much less $2 billion — but you would assume it dominated the year given all the discussion of it.

Why that happened is pretty simple: journalists understand Twitter. Probably every major journalist is on it and tweets dozens, if not hundreds, of times per day. One of the things a friend of mine said to me when Twitter was first blowing up was, “That seems like a thing that would only be relevant if you were a journalist, a comedian, or a huge company trying to sell shit.” This was like 2010. In many ways, those three chunks represent a lot of what Twitter is, so perhaps my friend has a future in horse race wagering.

Plains GP Holdings is currently trading at $23.56. Goldman Sachs has it as a “conviction buy” with robust growth possibilities. Seeking Alpha believes the Plains GP stock could be the most profitable way to tape into Plains All-American Pipeline. The explainer for why the company went public despite the successes of Plains All-American — which moves about 3.5 million barrels of crude oil and natural gas through its pipelines everyday — is explained here; essentially, though, the Plains GP IPO provided liquidity to the current Plains GP shareholders. Nick Einhorn, of Renaissance Capital, explained it this way as a “leveraged play” (warning: heavy finance-speak coming):

“Essentially, a 10-percent increase in PAA’s distribution per share will result in a 20% increase in Plains GP’s cash flow. Furthermore, Plains GP’s treatment as a C-corporation for tax purposes may appeal to investors that do not typically invest in limited partnerships like PAA due to the K-1 forms required,” says Einhorn.

34 banks underwrote the Plains GP IPO, including Barclays, Goldman Sachs and JP Morgan. Overall, the idea is that the success of the IPO could test demand for income-facing oil and gas stocks.

Is there a bigger lesson here? Probably not. If anything, remember that energy-related stocks and IPOs are always going to be raking it in, even if “it” doesn’t necessarily mean media attention. We can all relate to Twitter in some form or fashion. We can’t all relate to pipelines. Then again, though — ExxonMobil is trading at twice the rate of Facebook, so maybe we should all be thinking less about the flashy, well-covered IPOs and more about the tried-and-true energy stocks.