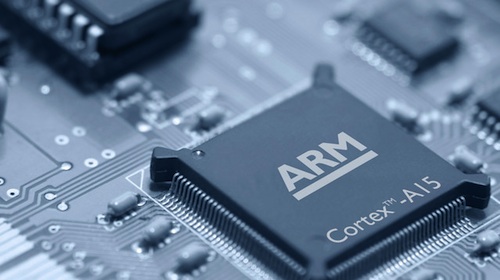

Wrap your head around this stat for a second: 64 percent of the world has access to proper sanitation (that’s somewhat of a low number, yes) and about 74 percent of the world has access to electricity (again, lower than you might expect). Now, 60 percent of the world — 4.3 billion people — interact with the products of one company on a given day. Facebook? Not even close. Google? Warmer, but no. Apple? No. Motorola? No. Actually, it’s ARM Holdings. Their slogan is “architecture for the digital world,” and they’ve shipped 50 billion chips to different manufacturers over their lifespan. Every single iPhone and iPad ever produced has an ARM chip inside, as do essentially 99 percent of the world’s mobile phones. Phrase it another way: McDonald’s is in 118 countries. ARM chips are in 196. It might be the single most-omnipresent brand in the world; as many people interact with ARM chips as have access to sanitation. Yet last year, the company had $1 billion in value; Intel, which markets itself as making chips (“Intel Inside”) had close to $53 billion in value. What gives?

The revenue gap represents a massive difference in philosophy and business strategy between the companies. Intel designs and manufactures its own chips. ARM, meanwhile, has engineers create chip designs that companies such as Apple, Samsung (005930:KS), and Qualcomm (QCOM) license, customize, and then pay manufacturing contractors to build. So ARM earns pennies on each smartphone sold by its customers via royalties, while Intel makes tens to hundreds of dollars on every chip it sells.

Ah… so the strategy should be “design and produce your own chips.” Could ARM Holdings do that?

Apparently it’s getting into the “server chips” game — marketed at huge companies, like Google, that buy up servers 20K at a time — but even in that space, it will have a tough time generating a lot more revenue. Intel competes in that area, and their chip is high-quality/low-cost, and previously companies like Qualcomm and Microsoft tried to sell ARM-driven, low-cost computers … and it didn’t work.

There is apparently good growth ahead in the royalty area, so some analysts are calling ARM’s stock “a buy,” although the broader lesson here is pretty simple: in America, if you want to make oodles of money on tech, don’t necessarily make something everyone needs and uses. Rather, make something that a lot of people need/use, but utterly control every aspect of its production. American business: from meetings to product plans, it’s really all about control in the end.