I just paid Installment No. 1 of my graduate school student loans two days ago. I hit “Submit” on that online form, basically muttered to myself “Here we go…,” realized it was probably another 30 years until I’d be totally done with it, and started silently weeping to myself about my future life and plans — especially since I didn’t even love graduate school that much, if we’re being honest. I know a thing or two about “money problems and mental health” (which is another way of saying “I’m a human being”), and then there’s all this:

Pull-quote, you ask? Why yes.

It’s no surprise that the study found that using debt to finance a college education can take its toll. “Cumulative student loans were significantly and inversely associated with better psychological functioning,” according to the results. That means, generally speaking, student-loan debt was not great for the mental health of study participants.

But with tuition prices soaring—according to the study, the price of higher education in the U.S. has increased by 250 percent in the past three decades when accounting for inflation—most students have to borrow money to pay for school. According to the Project on Student Debt, in 2013 seven out of 10 graduating college seniors were leaving school with student loans, which averaged $28,400.

** PUTS RIFLE TO SCROTUM **

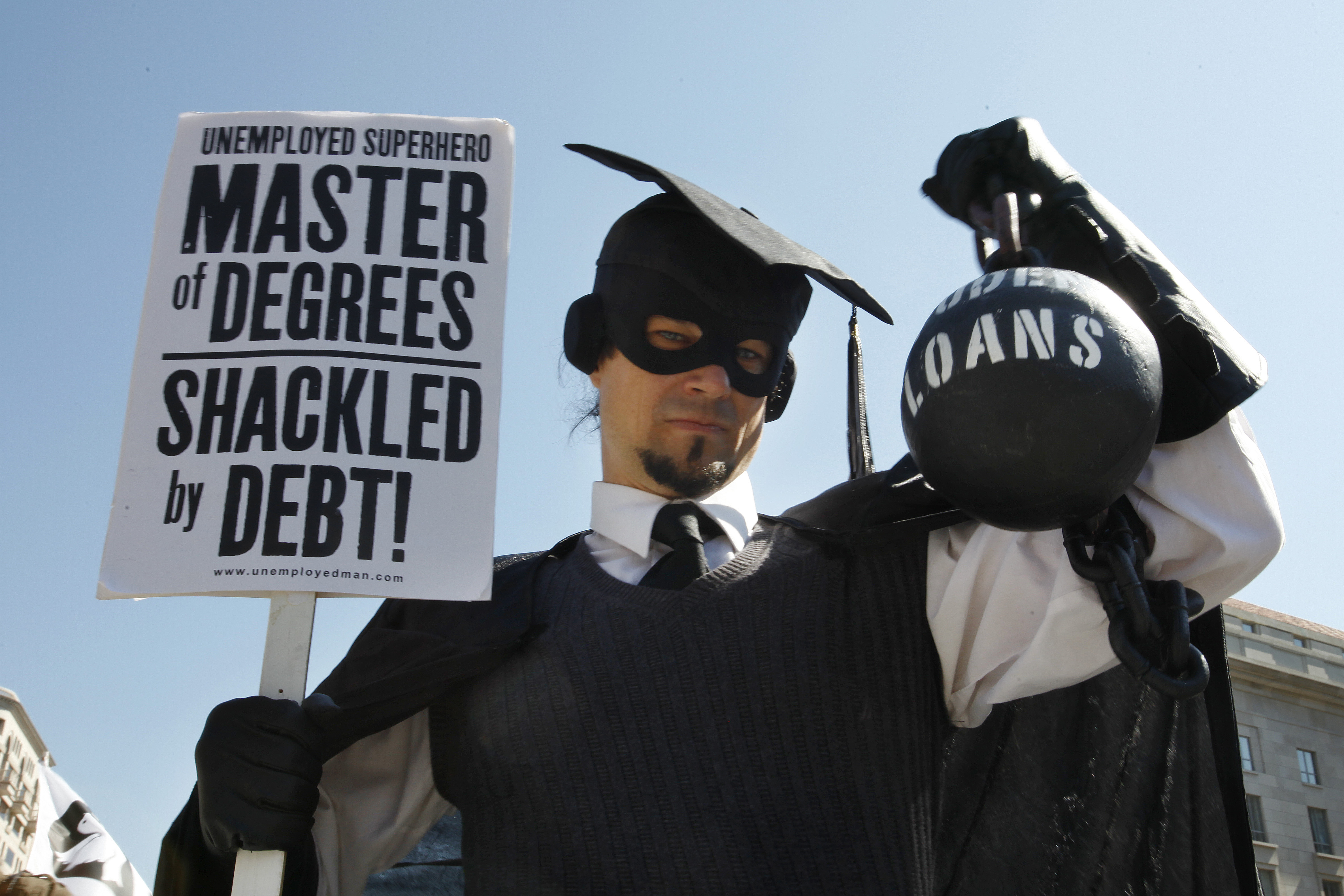

This student loan debt thing is a total f’n racket, honestly. People are going into $30K worth of debt and there’s essentially not even a guaranteed job on the other end, and if there is a job, chances are your earnings are coming in — and then staying! — relatively stagnant. Plus, the whole reason you went to a specific program or school may be based on inaccurate marketing and your school is likely hiring more support staff than actual professors at the same time.

Point being: that’s a lot of money to be in debt over something where there’s no true guarantee on the other end. If you take out a mortgage, you have a house. If you go into debt for a car or small business, you have a way to drive around or a company to try and make successful yourself (a real sense of accomplishment). Your $30K in debt from college/graduate school? All that basically provides you with is a vague notion that you “needed” to do that in order to be competitive in a job market that makes little to no sense anyway.

Kind of awkward, right?